A new roof in Orlando is one of the most critical investments you’ll make. It protects your family, enhances curb appeal, and provides vital defense against Florida’s intense sun and severe weather. Once you’ve chosen a reliable, local contractor like Top Builder Roofer, the next step is figuring out the most cost-effective and convenient way to pay for it.

With over 20 years in the roofing industry, I’ve seen countless homeowners successfully finance their projects. The best option isn’t always the one with the lowest APR—it’s the one that balances cost, speed, and simplicity for your unique financial situation. Let’s break down the top financing methods available for your roofing project.

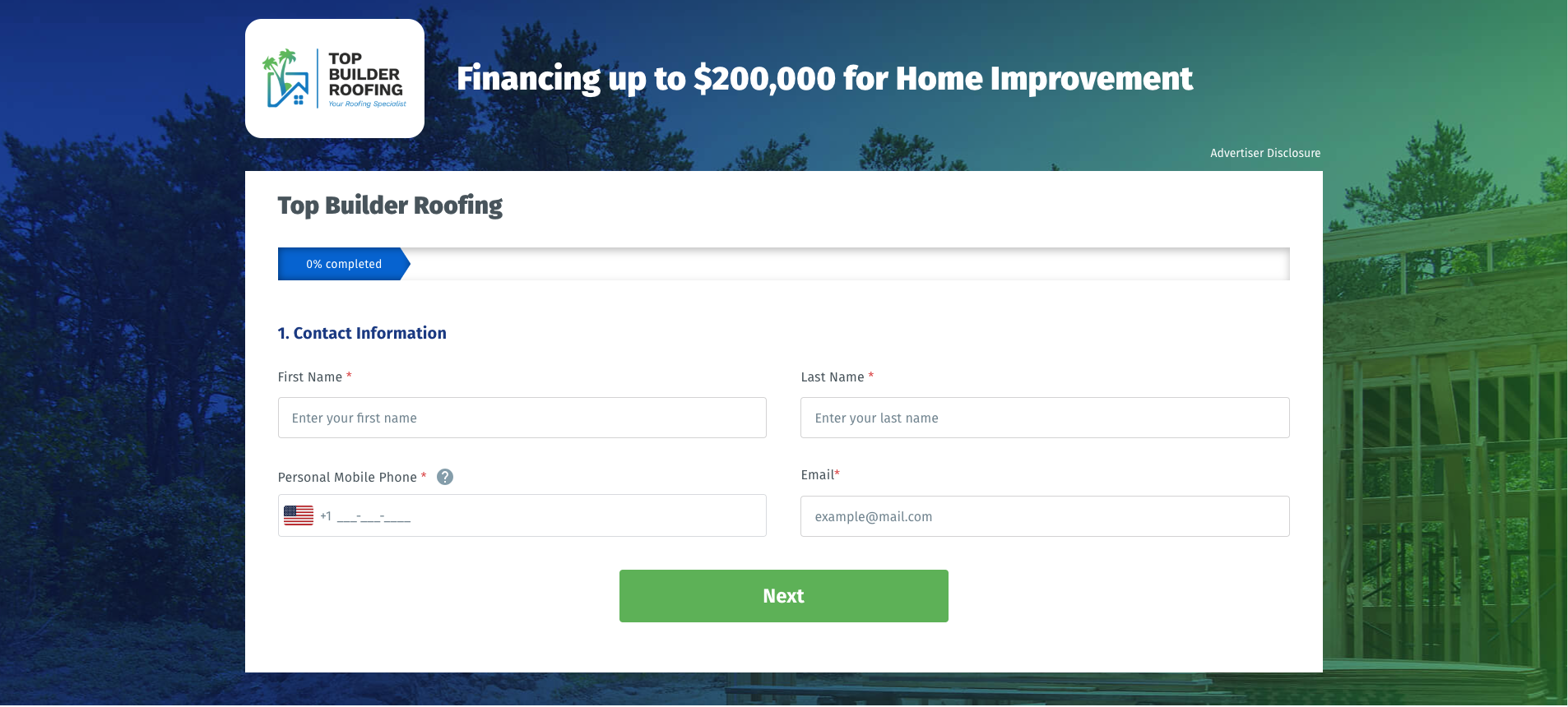

Contractor Financing: The Fast Track to a New Roof In Orlando

For Orlando homeowners needing immediate, hassle-free financing, a direct loan through your roofing contractor is often the best solution.

Why Choose Contractor Financing?

- Speed and Simplicity: Top Builder Roofer partners with reputable third-party lenders, allowing us to process your application and receive approval, often within minutes. This rapid turnaround is essential in Florida, where storm damage requires fast action to prevent further water intrusion.

- Convenience: The application is streamlined, often requiring less documentation than a traditional bank. There are typically no appraisals or significant closing costs, which can save you time and hundreds of dollars.

- Flexible Terms: Our lending partners offer a wide array of options, including competitive fixed rates, no-money-down programs, and flexible repayment terms that can extend for many years, helping keep monthly payments manageable.

Industry Insight: While contractor rates might sometimes be slightly higher than a secured Home Equity Loan, the speed and ease of getting approved often outweigh the marginal difference, especially when you consider the time and potential expense saved by preventing further damage to your home’s interior.

Home Equity and Traditional Bank Loans: The Secured Route

If you have a strong credit profile and substantial equity in your home, a traditional bank loan could be a strong contender due to potentially lower, secured interest rates.

Home Equity Loan (HEL) or Line of Credit (HELOC)

- Lower Rates: Since your home is used as collateral, these loans typically offer some of the lowest interest rates on the market (as of Q3 2024, competitive personal loan APRs for good credit often start around 6.74% to 8.74%, while home equity rates can be even lower).

- Potential Tax Deduction: Interest paid on a HEL or HELOC may be tax-deductible if the funds are used for home improvements, unlike interest on an unsecured loan.

The Trade-Offs: Securing a loan with your home carries the risk of foreclosure if you default. Furthermore, the process is slower—requiring appraisals, title checks, and underwriting—which can delay your roof replacement by several weeks.

Unsecured Personal Home Improvement Loan

Faster Than HELOCs: While generally slower than contractor financing, approval is usually quicker than a HELOC since there is no appraisal requirement.

Fixed Rates, No Collateral: These bank or credit union loans require no home equity, meaning your home is not at risk. They offer predictable, fixed monthly payments.

Credit Cards: The Short-Term Fix

For homeowners with excellent credit, using a credit card with a 0% introductory APR for a small-to-medium project can act as a short-term, interest-free loan.

The Risk:

This is only a viable strategy if you are 100% confident you can pay off the full balance before the promotional period ends. Once the regular, often high, APR kicks in (which can be over 20-30%), the cost of your roof replacement can skyrocket, making this the riskiest long-term option.

PACE Financing: The Government-Backed Option (FL Homeowners)

The Property Assessed Clean Energy (PACE) program is a unique option for Florida homeowners replacing their roofs with energy-efficient or storm-resistant materials.

PACE Benefits for Roofing:

- No Upfront Payment: PACE typically finances 100% of the cost with no money down.

- Repaid via Property Taxes: The loan is repaid through an assessment added to your annual property tax bill, with terms often extending 15 to 20 years.

- Accessibility: Eligibility is based on property equity and tax payment history, not solely on credit score, making it accessible to a wider range of homeowners.

Crucial Consideration: The debt is tied to the property, not the individual. While this can transfer to a new owner if you sell, it is often a senior lien, meaning your mortgage lender and any future buyer’s lender may require the PACE balance to be paid off before a sale or refinance can close. It is vital to understand the full implications before committing.

Making Your Informed Decision

| Financing Option | Best For | Key Advantage | Key Disadvantage |

| Contractor Financing | Fast, urgent repairs, maximizing convenience | Quick approval (minutes), minimal paperwork | Rate may be slightly higher than secured loans |

| Home Equity Loan/HELOC | Large projects, homeowners with high equity | Lowest potential interest rates, fixed payments | Slowest process (weeks), puts home at risk (collateral) |

| Unsecured Personal Loan | Moderate-sized projects, no home equity | Fixed payments, no collateral required | Higher interest rate than secured loans |

| PACE Financing | Energy-efficient upgrades, low upfront cost | 100% financed, paid through property taxes | Debt tied to property, complex for selling/refinancing |

Ultimately, the “best” loan is the one that gets your new roof in Orlando fixed quickly, safely, and affordably, without causing undue financial strain. Our team at Top Builder Roofer works tirelessly to ensure you have a clear path forward.

Call Top Builder Roofer today for a free roof inspection and let’s discuss the flexible financing options available to start your project immediately!